Why PE Firm & M&A IT Solution Success Demands Strategic Planning

PE Firm & M&A IT Solution planning is critical for deal success. Research shows that 70% of process and systems integrations fail early on, and up to 50% of M&A deals fail to close, often due to unmanaged technology issues. Private equity firms and their portfolio companies face unique challenges, from IT due diligence to post-merger integration.

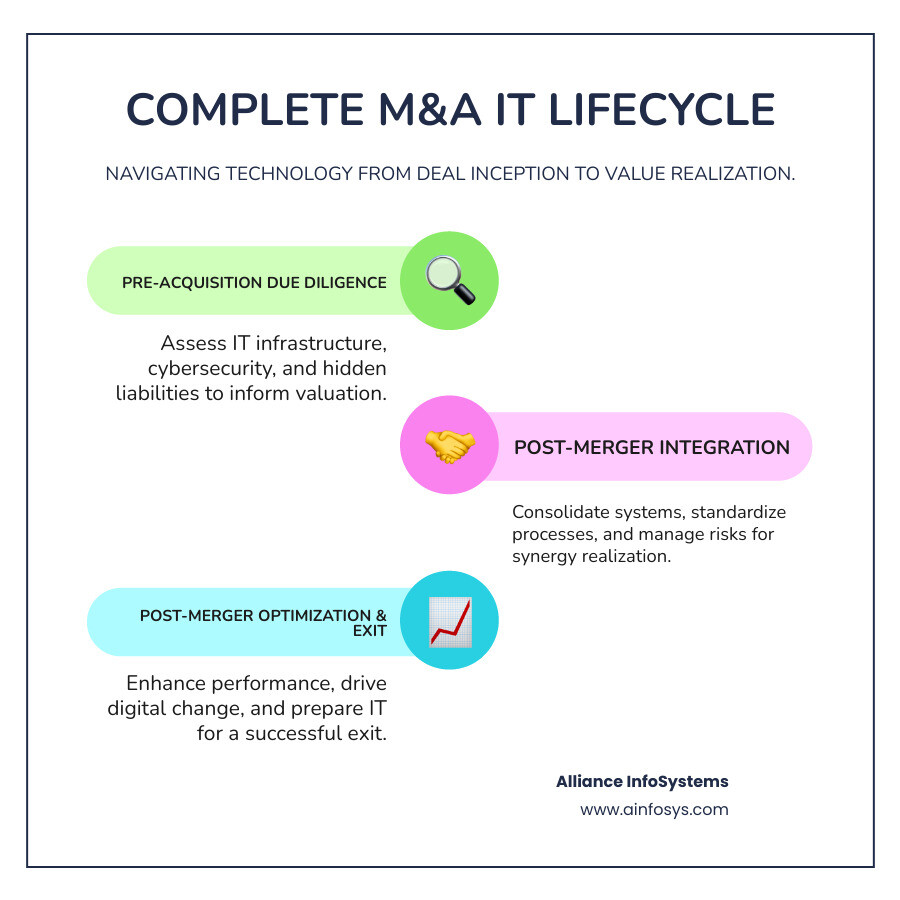

Key components of a successful strategy include:

- IT Due Diligence: Assess infrastructure, cybersecurity, and technical debt pre-close.

- Integration Strategy: Standardize systems and processes across acquired companies.

- Risk Management: Address the fact that more than one in three executives experience data breaches during M&A integration.

- Cost Optimization: Realize 10-15% in cost savings through standardization and vendor consolidation.

- Exit Preparation: Document IT environments to demonstrate scalability to buyers.

Whether evaluating targets or preparing for integration, the right IT strategy is the difference between success and failure. Technology is both a risk and a value creation opportunity. The key is knowing what to look for, how to integrate effectively, and when to leverage specialized IT services that understand the demands of PE firms and M&A transactions.

The Pre-Acquisition Gauntlet: IT Due Diligence and Valuation

When private equity firms evaluate acquisition targets, the real story often hides beneath glossy presentations. The same principle as a home inspection applies to PE Firm & M&A IT Solution strategies: you need to look for hidden cracks before you buy. IT due diligence isn’t just a checkbox exercise – it’s your financial lifeline.

This detective phase uncovers hidden liabilities and golden opportunities for value creation. Understanding the strategic value of IT in M&A is essential for deal success, especially when 1 in 3 data breaches happen during M&A integration.

Key IT Challenges in M&A

Every M&A deal has IT headaches. Here are the most common challenges we’ve seen over two decades:

- Disparate systems: Trying to integrate different systems like Salesforce and HubSpot or AWS and Azure creates a complex puzzle.

- Technical debt: Shortcuts like delaying upgrades or patching instead of replacing accumulate over time and become a massive financial burden.

- Legacy software: Critical business functions running on outdated systems are expensive and complicated to integrate with modern technology.

- Cybersecurity vulnerabilities: An acquisition target with poor security is a lawsuit waiting to happen. Are you at risk of a cyberattack? is a question you must answer.

- Compliance gaps: Inheriting a target’s non-compliance with regulations like HIPAA can turn a great deal into a legal nightmare.

- Key-person dependencies: When the entire IT operation depends on one person, their departure can cripple the company.

The IT Due Diligence Checklist

We approach IT due diligence like a comprehensive health checkup for your potential acquisition.

- Infrastructure assessment: We examine servers, networks, and hardware. Can the current infrastructure handle growth, or will it require immediate, major investments?

- Application portfolio review: We catalog all software to find redundancies, high licensing costs, and integration capabilities.

- Cybersecurity posture analysis: We examine firewalls, patch management, employee training, and incident response plans. A weak posture is a major business risk.

- IT organization and talent evaluation: We assess the skills, workload, and documentation practices of the IT staff to ensure the technology can be managed effectively.

- Budget and spending analysis: We dig into contracts and maintenance agreements to reveal the true cost of IT and find wasted spending.

- IT Governance Consulting: We examine how technology decisions are made to ensure IT aligns with business objectives.

How IT Findings Impact Deal Valuation

Our detective work pays off in real dollars and cents, translating directly into negotiating power.

- Quantifying risks: We put a price tag on problems, like the cost of replacing an outdated server or the potential damages from a security breach.

- Cost of remediation: The cost to fix issues, such as $200,000 in security upgrades, should reduce the acquisition price or be factored into your investment plan.

- Calculating potential synergies: We look for opportunities to consolidate vendors and platforms, identifying immediate cost savings.

- Identifying digital change potential: We find hidden value, such as automating manual processes or implementing data analytics to drive revenue.

- Adjusting EBITDA: Identified cost savings directly improve cash flow, while necessary new investments can reduce effective earnings.

- Negotiating leverage: Concrete data with quantified impacts gives you the ammunition to negotiate better terms, lower prices, or protective clauses.

Thorough due diligence is the foundation of PE Firm & M&A IT Solution success. You can’t manage what you don’t understand, and you can’t value what you haven’t assessed. Smart PE firms use IT due diligence not just to avoid disasters, but to uncover hidden value.

The Core of a PE Firm & M&A IT Solution: Integration Strategy

After the deal closes comes the moment of truth: post-merger integration. This is where many deals go sideways, as 70% of process and systems integrations fail in the beginning. The complexity touches everything from strategic vision to daily workflows.

However, when IT integration is done right, it becomes a powerful value driver. A successful PE Firm & M&A IT Solution can realize 10-15% in cost savings through smart standardization and vendor consolidation. We’ve seen how changing technology infrastructure for growth and efficiency transforms acquisitions into success stories. The key is building a foundation for sustainable growth, not just patching systems together.

Critical Components of a Post-Merger Integration Plan

Successful IT integration requires careful orchestration. Here’s how we create harmony:

- Integration Management Office (IMO): This nerve center is where key stakeholders make decisions, allocate resources, and maintain alignment. Without it, efforts devolve into chaos.

- Clear governance structure: Defining roles and decision-making authority for system choices and budgets avoids endless meetings and finger-pointing.

- Communication plan: Integration is about people. Transparent, regular communication manages expectations and builds buy-in, reducing resistance to change.

- 100-day plan: The first three months are make-or-break. We outline immediate priorities, identify quick wins, and establish foundational steps for deeper integration.

- Synergy tracking: We establish clear metrics to measure cost savings and efficiency gains, allowing for quick course correction and proving ROI.

- Cloud Migration Guide: Moving systems to the cloud is a common integration challenge that requires careful planning to ensure data integrity and minimize disruption.

The Unified vs. Disparate Systems Debate

One of the biggest decisions is whether to standardize on unified systems or manage disparate platforms. We strongly advocate for the unified approach, and the numbers back it up.

| Feature | Unified IT | Disparate IT |

|---|---|---|

| Operational Efficiency | Standardized platforms, streamlined workflows | Siloed data, inefficient processes |

| Support | Centralized support, consistent service | Fragmented support, inconsistent quality |

| Cost | Lower Total Cost of Ownership (TCO) | Higher operational and maintenance costs |

| Security | Improved security posture, easier compliance | Increased risk, harder to manage compliance |

| Data | Consistent data, improved analytics | Inconsistent data, limited insights |

| Scalability | Easier to scale, agile for future growth | Complex to scale, hinders expansion |

| User Experience | Simplified, consistent experience for employees | Confusing, frustrating for users |

A unified approach improves operational efficiency with standardized tools and smoother workflows. Economies of scale deliver real savings through vendor consolidation and bulk discounts. Data consistency provides a single source of truth for better strategic decisions, often underpinned by understanding the business benefits of virtualization. A unified system also offers an improved security posture and a better user experience for employees. While the initial effort can seem daunting, the long-term benefits are significant.

Critical Success Factors for Your PE Firm & M&A IT Solution

Technical expertise alone isn’t enough. These factors separate successful integrations from expensive failures:

- Executive sponsorship: Strong leadership provides the authority and resources to make tough decisions and keep the project on track.

- Early planning: Involving IT during due diligence helps identify challenges and opportunities before they become expensive surprises.

- Strong project management: Experienced project managers steer complex initiatives, manage risks, and ensure milestones are met on time and on budget.

- Cultural integration & Change management: Addressing the human side of change through training, communication, and support is crucial. When people understand the ‘why,’ resistance turns into enthusiasm.

- Choosing the right partner: As we discuss in what should you look for in a business technology partner?, an experienced partner with a proven M&A track record is essential.

Focusing on these factors helps PE firms turn IT integration from a necessary evil into a strategic advantage.

Leveraging Technology for Growth and a Successful Exit

You’ve acquired a company and steerd integration; now it’s time to turn that investment into a growth engine. In this phase, technology becomes a secret weapon for value creation. A strategic PE Firm & M&A IT Solution transforms portfolio investments into digital powerhouses that command premium valuations at exit.

Driving Digital Change in Portfolio Companies

PE-backed companies often have untapped potential due to outdated processes or underused technology. Strategic digital change can open up significant value.

- Process automation: We identify and automate manual, time-consuming tasks in finance, inventory, and customer onboarding. This frees up your team for strategic work and improves how to optimize your productivity at work.

- Data analytics: We implement systems that turn raw data into actionable insights, enabling data-driven decisions for sales, operations, and finance teams.

- Cloud adoption: Our Cloud & Virtualization Services create flexibility, allowing portfolio companies to scale rapidly or expand to new markets without massive capital investments.

- Customer experience improvement: We implement solutions like AI-powered support or digital self-service platforms to make it easier for customers to do business with you.

- Building scalable platforms: We create technology foundations that can grow with ambitious expansion plans, ensuring systems don’t break under pressure.

Every change should directly support growth objectives and add measurable value.

Preparing for a Strategic M&A Exit

When it’s time to sell, technology preparation can make or break your exit strategy. You want to present a low-risk, high-growth opportunity.

- Clean data rooms: Buyers expect well-organized, comprehensive documentation of your IT environment, from software licenses to security policies.

- Documented IT environments: Clear documentation demonstrates professionalism, reduces perceived risk, and gives buyers confidence in their investment.

- Standardized systems: Consolidated platforms and streamlined processes are highly attractive to buyers, signaling efficiency and ease of future integration.

- Strong cybersecurity posture: Buyers don’t want to inherit vulnerabilities. We help ensure robust defenses and demonstrate a commitment to improving enterprise information security.

- Demonstrating scalability and low risk: A modern, well-managed IT infrastructure shows buyers they can focus on growth, not technology overhauls.

The goal is to present a turn-key operation. When buyers see technology as an asset, it translates to higher valuations and smoother exits. This preparation is an ongoing process, not a last-minute task.

Specialized IT Services: Your Strategic Toolkit for M&A Success

Managing a portfolio through complex M&A transactions requires more than typical IT support. You need a partner who understands the private equity world—the timelines, value creation goals, and the need for clear ROI.

A proactive PE Firm & M&A IT Solution provider thinks three steps ahead, identifying potential issues before they become deal-breakers. As we explore in what does an IT consultant really do?, the goal is to become an extension of your team, building value in your portfolio companies and positioning them for successful exits.

Essential Services in a PE Firm & M&A IT Solution

The right IT partner brings a toolkit designed for the M&A lifecycle:

- Fractional CIO/vCIO services: Get executive-level strategic IT leadership for business planning and digital roadmaps at a fraction of the cost of a full-time hire.

- Managed Security: We provide comprehensive cybersecurity, including threat detection, vulnerability management, and incident response plans. This is essential, as over a third of executives experience data breaches during M&A.

- Data Backup & Recovery: Robust backup and disaster recovery plans are critical to protect your investment from cyberattacks, natural disasters, or human error.

- Compliance management: We provide specialized knowledge to ensure portfolio companies meet industry-specific standards like SOC 2 and HIPAA, making them more attractive to buyers.

- IT Augmentation: Fill critical skill gaps for large-scale migrations or complex integrations without the overhead of hiring full-time employees for temporary needs.

- Vendor management: We centralize vendor relationships, negotiate better contracts, and ensure SLAs are met, resulting in better service and significant cost efficiencies.

Demonstrating Value: The IT Partner’s Proposition

Private equity firms need to see clear, measurable value from every investment. We don’t just say we add value—we prove it.

- Risk mitigation: We proactively identify and address IT vulnerabilities, reducing the risk of costly data breaches, operational disruptions, and compliance failures.

- Cost savings reports: We provide transparent reports showing tangible savings from standardization, vendor consolidation, and optimized IT spending, aiding your Top IT Investments 2025 Budget planning.

- Performance metrics and KPIs: We establish and report on clear KPIs (e.g., system uptime, response times) to demonstrate continuous improvement and efficiency gains.

- Strategic roadmaps: We partner with you to develop forward-looking IT roadmaps that align technology investments with your growth and exit strategies.

Our proven track record over 20 years shows we understand that PE firms need partners who contribute strategically to the profitability of their investments. That’s what we deliver.

Conclusion

The M&A journey is fraught with risk, but technology doesn’t have to be a hidden danger. Instead, it can be your secret weapon for creating real value. While 70% of integrations fail and data breaches are common, a strategic PE Firm & M&A IT Solution can be the difference between success and failure.

From uncovering risks during IT due diligence to realizing 10-15% cost savings during integration, and finally preparing a low-risk, high-value company for exit, technology touches every stage. The right IT partner helps build a foundation for growth, efficiency, and a profitable exit.

The value of a strategic IT partner is in understanding your investment goals and pressures. Whether you need fractional CIO services, managed security, or help preparing clean data rooms, the right partner brings expertise exactly when you need it.

For over 20 years, Alliance InfoSystems has provided flexible and cost-efficient IT solutions for complex business challenges. We know what makes the difference in M&A success. Let us be your strategic partner in turning technology from a risk into your competitive advantage. Explore our Managed IT Services and find how we can help you achieve your M&A goals.