Why Private Equity IT Services Are Critical for Deal Success

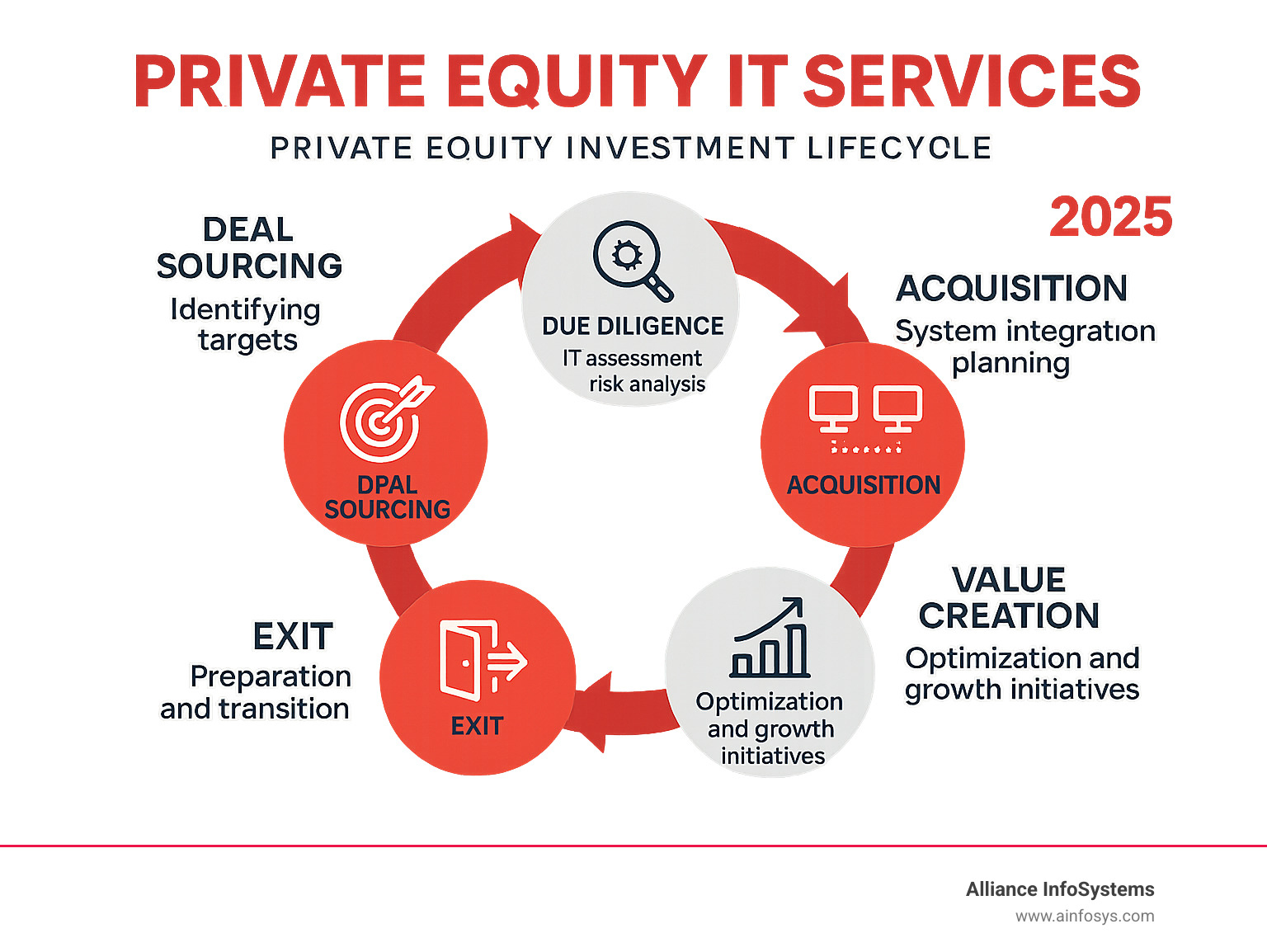

Private Equity IT Services are essential for maximizing portfolio value through strategic technology management, cybersecurity, and M\&A integration. These services support the entire investment lifecycle, from due diligence to exit planning. Key services include IT assessment, system integration, operational optimization, cybersecurity, and strategic support.

Global IT services spending surpassed $1.5 trillion in 2024, with nearly 10% growth projected for 2025, reflecting the increased reliance on digital infrastructure. However, most enterprises lack the in-house expertise to meet their technology goals, creating both risk and opportunity for PE firms. While poor IT can derail deals, the right partnership transforms technology from a cost center into a value creation engine.

With high business failure rates (50% within five years, per the Bureau of Labor Statistics), strategic IT support is essential for PE firms to protect investments and maximize returns.

Why Strategic IT is No Longer Optional for Private Equity

The private equity landscape has fundamentally shifted. What was once a back-office necessity is now a critical value driver. Today’s PE firms know that technology isn’t just about keeping the lights on—it’s about maximizing returns and protecting investments.

IT services spending continues to climb, with nearly 10% growth projected for 2025. This reflects the reality that Private Equity IT Services have become essential for deal success. The recent acceleration of digital change proved that companies with robust IT thrived, while those with weak infrastructure struggled.

The stakes couldn’t be higher. According to the Bureau of Labor Statistics, 50% of businesses don’t make it past five years, often due to operational inefficiencies that strategic IT can prevent. Smart PE firms now recognize that technology directly impacts EBITDA by driving profitability and competitive advantage.

The Challenge: Overcoming Portfolio IT Problems

Many portfolio companies are held back by their technology. Common issues that destroy value include:

- Legacy Systems: Outdated platforms create “technical debt”—the hidden cost of maintaining inefficient systems that hinder integration and change.

- Integration Complexity: Merging acquisitions with incompatible systems makes it difficult to realize planned synergies.

- Scalability Roadblocks: Infrastructure that can’t handle growth creates frustrating limitations when success accelerates.

- Expertise Gaps: Most enterprises lack the specialized internal talent for modern IT management, especially small to mid-sized companies.

- Cybersecurity Threats: Ransomware and data breaches have become existential risks, capable of shutting down operations and causing massive financial damage.

- Compliance Requirements: Complex regulations like HIPAA and PCI DSS create costly obligations that are difficult to meet consistently.

For insights on addressing these security challenges, check out our guide on How to Improve Enterprise Information Security.

The Opportunity: Turning IT into a Value Creation Engine

Every IT challenge is a value creation opportunity. Strategic technology investments deliver measurable returns by enabling:

- Streamlined Operations: Modernizing infrastructure and optimizing workflows with technologies like AI and data analytics improves efficiency.

- Improved Data Analytics: Deeper insights into performance, markets, and customer behavior drive smarter strategic decisions.

- Faster Decision-Making: Real-time data creates competitive advantages by enabling rapid responses to market changes.

- Accelerated Growth: Removing IT bottlenecks allows portfolio companies to scale with confidence.

- Maximized Exit Valuations: Modern, secure, and well-managed IT infrastructure commands premium prices from buyers and directly boosts EBITDA.

Changing reactive IT management into a strategic technology partnership is a key opportunity. See how this works in our case study on Enhancing Company Growth Through CTO Services.

The Core Components of Private Equity IT Services

For a private equity portfolio, technology is the backbone that supports or sabotages investment returns. Private Equity IT Services must work seamlessly across the entire investment journey, from acquisition to exit. Every deal has a technology story, whether it’s outdated systems holding back a company or untapped potential waiting for the right IT strategy. The key is having the right support at each critical moment.

Pre-Acquisition: Comprehensive IT Due Diligence

Before a deal closes, IT due diligence is critical to uncover hidden risks and costs. This process is your best defense against post-acquisition surprises.

- IT Infrastructure Assessment: We evaluate existing hardware, software, and networks to identify technical debt and future capital expenditures.

- Cybersecurity Risk Analysis: We assess the target’s security posture to find vulnerabilities before a breach can devalue the investment.

- Software Licensing Review: Our team verifies licensing to prevent costly fines from non-compliance post-acquisition.

- Scalability Evaluation: We determine if the current IT can support your growth plans without requiring a complete overhaul.

- Identifying Hidden Costs: We uncover inefficient processes and redundant systems that drain resources and reduce EBITDA.

- Compliance Gap Analysis: Our analysis pinpoints where the company fails to meet industry regulations, preventing future legal penalties.

For insights into managing change during these assessments, see our case study on A Change Journey.

Post-Acquisition: Seamless Integration and Optimization

After the deal closes, our Private Equity IT Services turn integration challenges into value creation opportunities.

- System Integration Planning: We develop a strategic roadmap to merge IT systems, applications, and data to realize planned synergies.

- Merging Disparate Platforms: Our team consolidates operating systems, databases, and applications to create a unified, efficient IT environment.

- Standardizing Technology Stacks: We reduce complexity and improve manageability, often leveraging cloud solutions for agility and cost savings. Our Cloud & Virtualization Services can guide this transition.

- Optimizing Workflows: We re-engineer business processes to take full advantage of new, integrated systems, boosting productivity and cutting costs.

- Change Management Support: We guide staff through the transition with training and support to ensure smooth adoption of new technology.

Ongoing Management: Proactive Support for Your Portfolio

Portfolio companies need consistent, expert support for sustainable growth. Our Managed IT Services provide proactive management that lowers total cost of ownership.

- 24/7 Monitoring: We watch systems and networks around the clock to detect and resolve issues before they impact operations, ensuring high uptime.

- Helpdesk Support: Our team provides immediate help for end-users, minimizing downtime and keeping productivity high.

- Data Backup and Recovery: With our Data Backup and Recovery services, we ensure business continuity with real-time replication and rapid recovery capabilities.

- Performance Optimization: We continuously fine-tune IT systems for peak efficiency, ensuring your technology investments deliver ongoing returns.

- Strategic IT Guidance (vCIO): Our virtual CIO services help align technology with business goals, ensuring IT investments drive value creation.

With over 20 years of experience, we handle the technology complexities so you can focus on creating value.

Fortifying Your Investments: Cybersecurity and Compliance

When a single ransomware attack can destroy years of value, cybersecurity becomes the most important conversation in the boardroom. For private equity firms, it’s the foundation that protects every dollar invested. The threat landscape is intense, with sophisticated attacks targeting the financial sector. The question isn’t if a portfolio company will face a threat, but when and how prepared it will be. Our private equity IT services focus on building proactive defenses. For a real-world example, see our case study From Breach to Bulletproof.

Building a Resilient Cybersecurity Posture

A strong defense requires multiple layers of digital protection working together.

- Managed Security: Our Managed Security services provide 24/7 monitoring and Managed Detection and Response (MDR) to stop threats before they cause damage.

- Penetration Testing: We use ethical hackers to find and fix vulnerabilities before malicious actors can exploit them.

- Employee Security Training: Since human error is a leading cause of breaches, we provide practical training to help teams spot phishing attempts and handle data safely.

- Incident Response Plan: We develop clear, actionable plans to minimize damage and ensure rapid recovery when incidents occur.

- Virtual CISO (vCISO): For elite security leadership, our vCISOs develop strategic security infrastructure and ensure ongoing compliance. Learn more in our guide on What is SOC as a Service (SaaS)?.

Navigating the Regulatory Maze

Regulatory compliance is a complex, ever-changing requirement with severe penalties for failure. For PE firms with diverse portfolios, managing this is a significant challenge.

- Industry-Specific Compliance: We ensure portfolio companies meet legal requirements like HIPAA and PCI DSS, which vary by industry and location.

- Data Privacy Laws: Our team helps steer the complex web of data privacy laws like GDPR and CCPA, making compliance manageable.

- Audit Support: We prepare companies for audits by organizing documentation and processes, ensuring smooth reviews and successful outcomes.

- Reporting Frameworks: We implement systems for accurate, automated reporting to demonstrate ongoing compliance to regulatory bodies.

A strong compliance posture avoids fines and builds trust, increasing exit valuations by demonstrating operational maturity and reduced risk.

Choosing the Right IT Partner for Your PE Firm

Finding the right IT partner for your private equity firm isn’t just about technical skill—it’s about finding a team that understands your world. The nature of PE deals, the pressure to maximize EBITDA, and the complexity of managing a diverse portfolio require specialized IT expertise.

At Alliance InfoSystems, we’ve been supporting businesses from our Maryland headquarters since 2004. Our 20 years of experience have taught us that successful private equity IT services partnerships are built on a deep understanding of the investment lifecycle.

Your ideal partner must have experience with PE firms, offer scalable solutions, and possess deep security expertise. A proven track record and strong cultural fit are also essential. You need a partner who communicates clearly, responds quickly, and aligns with your firm’s values.

Key Qualities of a Top-Tier Private Equity IT Services Provider

The best providers think like investors. Look for a partner who:

- Understands PE Deal Cadence: They move at your speed, delivering quality assessments on tight deadlines.

- Focuses on EBITDA Improvement: Every IT decision is aimed at improving the bottom line by cutting costs, automating processes, and optimizing systems.

- Thinks Strategically: They act as a virtual CIO, aligning technology with your long-term investment strategy to maximize exit valuations.

- Provides Transparent Reporting: You receive clear, concise updates on performance, security, and ROI—no technical jargon.

- Offers Flexible Service Delivery: The right partner provides adaptable options, like flexible IT Augmentation, to meet your specific needs.

Red Flags to Avoid in a Private Equity IT Services Partner

Be cautious of partners with these red flags:

- One-Size-Fits-All Approaches: Your portfolio requires customized solutions, not generic templates.

- Lack of M&A Experience: Inexperience with IT due diligence and integration can create costly delays and nightmares.

- Poor Communication: Slow or unclear communication during evaluation signals future frustration.

- Inflexible Contracts: Your IT partnership must adapt to changing needs, not lock you into rigid terms.

- Hidden Fees: Demand complete transparency in pricing to avoid unexpected costs that derail financial projections.

For deeper insights, explore our whitepaper 7 MSP Myths That Need to Be Busted.

Frequently Asked Questions about Private Equity IT Services

When considering private equity IT services, PE firms often have pressing questions about ROI, risk, and implementation. Here are answers to the most common concerns.

How do IT services directly improve a portfolio company’s EBITDA?

Strategic IT management transforms technology from a cost center into a profit driver. It improves EBITDA by:

- Slashing Operational Costs: Automation, optimized infrastructure, and cloud migrations reduce labor and hardware expenses. Managed services also eliminate the need for costly in-house IT staff.

- Minimizing Expensive Downtime: Proactive 24/7 monitoring prevents issues that could cost thousands per hour in lost revenue.

- Avoiding Costly Fines: We help companies prevent multi-million dollar security breaches and compliance penalties that directly impact the bottom line.

- Enabling Faster Growth: Optimized IT removes technology bottlenecks, allowing companies to scale efficiently and pursue aggressive expansion.

What are the most critical cybersecurity risks for PE portfolio companies?

PE portfolio companies are prime targets due to their financial resources and data. The most critical risks include:

- Ransomware Attacks: These can halt operations entirely, with criminals demanding millions. Recovery is never guaranteed, and downtime can last for weeks.

- Data Breaches: The exposure of sensitive data leads to enormous financial and reputational costs from fines, legal fees, and lost business.

- Business Email Compromise (BEC): Criminals impersonate executives to trick employees into making fraudulent financial transactions.

- Intellectual Property Theft and Insider Threats: Malicious actors can steal trade secrets, while disgruntled employees can cause significant damage from within.

The threat landscape is constantly evolving, making continuous monitoring and regular security assessments essential.

How can an IT partner ensure a smooth technology transition during an acquisition?

A smooth transition requires careful planning, clear communication, and expert execution.

- Pre-Acquisition Due Diligence: We start by thoroughly assessing the target’s IT to identify challenges, vulnerabilities, and hidden costs before the deal closes.

- Detailed Integration Roadmap: We create a clear blueprint for the merger, outlining timelines, resources, and risks to keep everyone aligned.

- Clear Communication: Our team provides regular updates to all stakeholders in clear business terms, addressing issues proactively.

- Hands-On Implementation: We work directly with staff to merge systems, migrate data, and train employees, often in phases to minimize disruption.

- Change Management Support: We provide comprehensive training and ongoing support to help employees adapt to new systems and ensure smooth adoption.

The goal is a seamless integration with minimal downtime, turning a complex process into a competitive advantage.

Conclusion

The private equity world moves fast, and technology must keep pace. As this guide has shown, private equity IT services are no longer an expense but a strategic weapon that can make or break your investments.

Strategic IT partnerships boost EBITDA by streamlining operations, protect investments from cyber threats, and transform technology into a competitive advantage that maximizes exit valuations. The firms that act on this reality are the ones pulling ahead.

At Alliance InfoSystems, we’ve spent over 20 years (since 2004) helping businesses leverage technology to create value. We understand the PE lifecycle and that you don’t have time for cookie-cutter solutions or vendors who can’t meet deal timelines. Our Maryland-based team delivers flexible, customized, and cost-efficient services that adapt to your needs.

Your portfolio companies need a partner who understands how technology drives business value.

Ready to see how the right IT partnership can transform your portfolio? Explore our Managed IT Services and find what two decades of experience in private equity IT services can do for your investments.